Some Known Facts About How To Find Out If Someone Has Life Insurance.

These financial investments are an essential part of the Australian economy, supporting services, markets, infrastructure jobs and the monetary system. Many insurance companies are owned by investors (consisting of superannuation funds and mutual fund) and the insurer has a responsibility to supply them with a return on their investment. The Australian Prudential Guideline Authority (APRA) has guidelines requiring insurance providers to have sufficient capital to pay an extremely high volume of claims.

Shopping around to find the policy that best matches your specific situations can cause you finding a less expensive policy. Nevertheless, shopping on cost alone may result in a policy that does not fulfill http://jaidennqxh799.iamarrows.com/the-smart-trick-of-what-is-comprehensive-insurance-vs-collision-that-nobody-is-talking-about your particular requirements and leaves you economically exposed to specific threats. Reducing your level of cover can decrease your premium, however it increases your danger of being underinsured.

Many insurance plan allow you to define an excess. In basic, a higher excess will suggest you pay a lower premium Many insurance companies will provide you a more affordable premium if you take actions to reduce your danger. You might receive a discount on your home and contents policy if you have security devices in location such as window locks and deadlocked doors.

Supplying additional details to the insurance provider about your particular danger might also enable your premium to be evaluated. You can also ask your insurance company about how you may be able to lower your premium Each insurance company will use products that differ from those provided by other insurers, with variations in thecoverage the conditions, exclusions and costs Some insurance companies may offer discount rates such as a no claims or multi-policy discount if you have 2 or more policies with one company If you pay your premium by instalments it usually costs you more than if you select to pay your premium in one annual swelling sum payment.

Upgraded November 30, 2020 Editorial Note: Credit Karma gets payment from third-party marketers, but that doesn't impact our editors' viewpoints. Our marketing partners do not examine, authorize or back our editorial content. It's precise to the finest of our knowledge when posted. Availability of items, features and discounts may differ by state or area.

We think it is very important for you to understand how we generate income. It's quite basic, in fact. The offers for monetary items you see on our platform originated from business who pay us. The cash we make assists us provide you access to complimentary credit rating and reports and helps us develop our other excellent tools and academic products.

However because we usually make cash when you discover a deal you like and get, we try to show you offers we think are a great match for you. That's why we supply features like your Approval Odds and cost savings quotes. Obviously, the deals on our platform don't represent all monetary products out there, but our objective is to reveal you as lots of terrific choices as we can.

Examine This Report on How Much Is Car Insurance A Month

Let's have a look at how an automobile insurance coverage premium works, the average insurance expenses and the aspects that can affect your insurance rates. Need automobile insurance coverage? Your premium is the amount of money you pay to an insurance coverage company to provide insurance coverage on your car. Your car insurance coverage premium may be paid monthly, every 6 months, and even simply as soon as a year, depending on the payment choices your cars and truck insurance provider provides.

Your car insurance coverage premium costs are based partially on the kinds of insurance coverage you choose, but other elements can affect your overall expense (more on that later). In every state except New Hampshire, you're needed to have a minimum quantity of coverage. This can assist safeguard your wallet by covering expenses as much as the coverage limit outlined in the policy you choose for example, to cover injuries or residential or commercial property damage you trigger another motorist in an accident.

The average liability insurance coverage premium nationwide was about $538 in 2015, according to the 2017 Car Insurance Coverage Database Report from the National Association of Insurance Commissioners, or NAIC. Averages varied from one state to another, with a low of $298 in North Dakota and a high of practically $870 in New Jersey.

The expense of your vehicle insurance coverage premium can depend on a number of different elements a few of which you can manage (for example, where you live or the kind of car you drive) and some that run out your control (such as your age). Need car insurance? Here are a few of the factors that could affect your vehicle insurance rates.

And picking high coverage limits and/or low deductibles will likely drive up your cost of automobile insurance, too. Are you a skilled driver without any imperfections on your record? Or do you have a few tickets and an accident or two in your driving history? Even the quantity of time you've been driving can affect your insurance coverage premium.

More youthful chauffeurs often pay more for insurance coverage due to the fact that they have less experience on the roadway and are at higher risk of being associated with an accident. When determining your premium, insurer think about a few factors connected to your vehicle, such as the cost to fix it and total security record.

Insurer utilize your credit-based insurance rating to anticipate the probability of you being in a mishap and suing. However note that California, Massachusetts and Hawaii have actually all banned the use of credit-based insurance coverage scores in figuring out insurance premiums. Do you have a long daily commute, or do you just drive to run errands on weekends? The more you drive, the higher your premium could be.

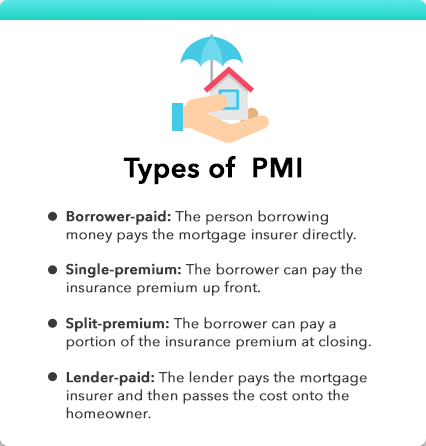

The Ultimate Guide To How Much Is Private Mortgage Insurance

Gather and compare insurance quotes from multiple car insurance business to assist you find the very best protection and rates for your needs (what is gap insurance and what does it cover). And make sure to inquire about any possible insurance coverage discounts or other methods you might be able to bring down the cost of your cars and truck insurance coverage premium. Required vehicle insurance coverage? Erik Deckers is an expert blogger and ghostwriter, and is the co-author of Branding Yourself, No Bullshit Social Network, and The Owned Media Doctrine.

Understanding fundamental medical insurance terms can help you pick the strategy that may be the ideal option for you. A health insurance premium is a month-to-month charge you pay every month for having medical insurance protection. Prior to selecting a health insurance, carefully consider: Your existing health Your average annual health care costs Your readily available annual earnings for out-of-pocket medical expenses Next, adjust your previous annual healthcare expenses for any modifications to your current health.

Strategies with low premiums typically do not begin providing protection till you have actually paid out-of-pocket for a significant portion of your medical costs. Other strategies might have greater regular monthly premiums, but cover a larger portion of your medical expenses., you're responsible for paying the complete premium to your medical insurance business monthly.

, your company may pay a portion of your premium. You'll be responsible for the rest, which you can frequently arrange to have actually subtracted from your wage monthly. You can not pay your medical insurance premium with funds from your health cost savings account (HSA). These tax-free funds can only be used for out-of-pocket medical expenditures.

An Unbiased View of What Is The Cheapest Car Insurance

These investments are an integral part of the Australian economy, supporting businesses, industries, infrastructure tasks and the financial system. A lot of insurance companies are owned by investors (including superannuation funds and mutual fund) and the insurer has a responsibility to offer them with a return on their investment. The Australian Prudential Regulation Authority (APRA) has rules requiring insurance providers to have adequate capital to pay an extremely high volume of claims.

Shopping around to find the policy that best suits your specific circumstances can cause you discovering a cheaper policy. However, shopping on rate alone may lead to a policy that does not meet your particular requirements and leaves you financially exposed to particular dangers. Minimizing your level of cover can decrease your premium, but it increases your risk of being underinsured.

Numerous insurance coverage allow you to define an excess. In basic, a greater excess will suggest you pay a lower premium Lots of insurers will provide you a more affordable premium if you take steps to decrease your risk. You might receive a discount rate on your home and contents policy if you have security gadgets in location such as window locks and deadlocked doors.

Providing extra info to the insurance provider about your specific danger might likewise permit your premium to be evaluated. You can likewise ask your insurance provider about how you may be able to decrease your premium Each insurance company will provide products that differ from those used by other insurance providers, with variations in thecoverage the terms, exemptions and expenses Some insurance providers may use discount rates such as a no claims or multi-policy discount if you have 2 or more policies with one company If you pay your premium by instalments it usually costs you more than if you pick to pay your premium in one yearly swelling sum payment.

Upgraded November 30, 2020 Editorial Note: Credit Karma receives settlement from third-party advertisers, but that does not affect our editors' opinions. Our marketing partners do not evaluate, approve or endorse our editorial material. It's accurate to the best of our understanding when posted. Availability of products, features and discount rates might vary by state or area.

We believe it is necessary for you to comprehend how we make cash. It's quite simple, in fact. The offers for financial products you see on our platform originated from business who pay us. The cash we make assists us provide you access to complimentary credit history and reports and assists us develop our other terrific tools and educational materials.

But because we normally generate income when you find a deal you like and get, we attempt to reveal you provides we think are an excellent match for you. That's why we supply features like your Approval Odds and savings estimates. Of course, the offers on our platform do not represent all monetary items out there, however our objective is to reveal you as numerous great options as we can.

The Best Guide To How Long Does An Accident Stay On Your Insurance

Let's take a look at how an automobile insurance premium works, the average insurance costs and the elements that can affect your insurance coverage rates. Need car insurance? Your premium is the quantity http://jaidennqxh799.iamarrows.com/the-smart-trick-of-what-is-comprehensive-insurance-vs-collision-that-nobody-is-talking-about of cash you pay to an insurance company to offer insurance on your automobile. Your automobile insurance premium may be paid monthly, every 6 months, or perhaps just as soon as a year, depending on the payment options your car insurance coverage company offers.

Your cars and truck insurance premium expenses are based partly on the types of insurance coverage you select, but other factors can impact your overall expense (more on that later). In every state except New Hampshire, you're needed to have a minimum quantity of coverage. This can help secure your wallet by covering expenses approximately the protection limit described in the policy you select for instance, to cover injuries or home damage you cause another driver in a mishap.

The average liability insurance premium across the country was about $538 in 2015, according to the 2017 Car Insurance Database Report from the National Association of Insurance Coverage Commissioners, or NAIC. Averages varied from one state to another, with a low of $298 in North Dakota and a high of practically $870 in New Jersey.

The expense of your cars and truck insurance coverage premium can depend upon a number of different elements some of which you can control (for instance, where you live or the kind of cars and truck you drive) and some that are out of your control (such as your age). Required vehicle insurance? Here are a few of the elements that might affect your vehicle insurance rates.

And choosing high protection limits and/or low deductibles will likely increase your cost of automobile insurance coverage, too. Are you a knowledgeable motorist with no acnes on your record? Or do you have a few tickets and a mishap or more in your driving history? Even the quantity of time you've been driving can affect your insurance coverage premium.

More youthful chauffeurs frequently pay more for insurance protection because they have less experience on the road and are at greater threat of being involved in a mishap. When identifying your premium, insurance provider consider a couple of aspects related to your car, such as the expense to fix it and total safety record.

Insurance provider use your credit-based insurance score to predict the possibility of you remaining in a mishap and suing. However note that California, Massachusetts and Hawaii have all banned using credit-based insurance coverage scores in figuring out insurance premiums. Do you have a long day-to-day commute, or do you only drive to run errands on weekends? The more you drive, the greater your premium could be.

Top Guidelines Of How Much Is Flood Insurance In Florida

Collect and compare insurance coverage quotes from numerous vehicle insurer to help you discover the very best protection and rates for your needs (how to fight insurance company totaled car). And make certain to ask about any prospective insurance discount rates or other ways you might have the ability to bring down the expense of your vehicle insurance premium. Required vehicle insurance? Erik Deckers is an expert blog writer and ghostwriter, and is the co-author of Branding Yourself, No Bullshit Social Media, and The Owned Media Doctrine.

Understanding standard health insurance terms can help you pick the strategy that might be the ideal choice for you. A health insurance premium is a month-to-month cost you pay each month for having health insurance protection. Before selecting a health insurance, carefully think about: Your existing health Your average annual healthcare expenses Your offered yearly income for out-of-pocket medical costs Next, change your previous annual health care costs for any changes to your current health.

Plans with low premiums frequently don't start providing protection until you have actually paid out-of-pocket for a considerable portion of your medical expenditures. Other strategies might have higher monthly premiums, however cover a larger portion of your medical expenses., you are accountable for paying the full premium to your medical insurance business every month.

, your employer might pay a portion of your premium. You'll be accountable for the rest, which you can frequently arrange to have actually deducted from your salary each month. You can not pay your health insurance coverage premium with funds from your health cost savings account (HSA). These tax-free funds can only be utilized for out-of-pocket medical expenditures.

An Unbiased View of How Much Renters Insurance Do I Need

These investments are an essential part of the Australian economy, supporting companies, markets, infrastructure tasks and the monetary system. Many insurance companies are owned by shareholders (including superannuation funds and financial investment funds) and the insurance provider has a commitment to supply them with a return on their financial investment. The Australian Prudential Regulation Authority (APRA) has rules requiring insurance providers to have enough capital to pay an extremely high volume of claims.

Shopping around to discover the policy that finest matches your specific circumstances can result in you discovering a cheaper policy. However, shopping on rate alone might result in a policy that does not fulfill your particular requirements and leaves you economically exposed to particular threats. Reducing your level of cover can reduce your premium, however it increases your risk of being underinsured.

Numerous insurance plan allow you to specify an excess. In basic, a higher excess will mean you pay a lower premium Many insurers will offer you a more affordable premium if you take actions to decrease your risk. You may get a discount rate on your home and contents policy if you have security gadgets in place such as window locks and deadlocked doors.

Providing extra information to the insurer about your specific risk might also permit your premium to be reviewed. You can likewise ask your insurance company about how you might be able to reduce your premium Each insurance company will use products that differ from those offered by other insurance companies, with variations in thecoverage the terms and conditions, exemptions and costs Some insurers might use discount rates such as a no claims or multi-policy discount rate if you have 2 or more policies with one business If you pay your premium by instalments it generally costs you more than if you choose to pay your premium in one yearly swelling sum payment.

Upgraded November 30, 2020 Editorial Note: Credit Karma receives compensation from third-party advertisers, but that does not impact our editors' opinions. Our marketing partners do not evaluate, approve or endorse our editorial content. It's accurate to the very best of our understanding when posted. Availability of products, functions and discounts may vary by state or territory.

We think it is necessary for you to comprehend how we earn money. It's quite easy, actually. The offers for financial products you see on our platform come from business who pay us. The cash we make helps us provide you access to totally free credit rating and reports and helps us create our other fantastic tools and educational materials.

However given that we usually earn money when you find a deal you like and get, we attempt to show you provides we believe are a great match for you. That's why we supply features like your Approval Odds and cost savings estimates. Of course, the deals on our platform do not represent all monetary items out there, however our objective is to show you as lots of terrific choices as we can.

The Best Strategy To Use For How To Get A Breast Pump Through Insurance

Let's have a look at how a car insurance coverage premium works, the typical insurance costs and the factors that can affect your insurance coverage rates. Required vehicle insurance? Your premium is the quantity of cash you pay to an insurance provider to offer insurance coverage on your vehicle. Your automobile insurance coverage premium might be paid monthly, every 6 months, and even just as soon as a year, depending upon the payment choices your car insurer uses.

Your car insurance coverage premium costs are based partly on the kinds of insurance protection you pick, however other aspects can affect your overall cost (more on that later). In every state except New Hampshire, you're needed to have a minimum amount of coverage. This can help safeguard your wallet by covering expenses as much as the protection limitation described in the policy you choose for example, to cover injuries or property damage you trigger another driver in a mishap.

The average liability insurance coverage premium nationwide was about $538 in 2015, according to the 2017 Vehicle Insurance Database Report from the National Association of Insurance Commissioners, or NAIC. Averages differed from state to state, with a low of $298 in North Dakota and a high of nearly $870 in New Jersey.

The expense of your car insurance coverage premium can depend on a variety of different elements a few of which you can manage (for instance, where you live or the kind of car you drive) and some that are out of your control (such as your age). Need vehicle insurance? Here are a few of the aspects that might affect your vehicle insurance coverage rates.

And picking high coverage limits and/or low deductibles will likely drive up your expense of vehicle insurance, too. Are you a knowledgeable chauffeur with no imperfections on your record? Or do you have a couple of tickets and an accident or 2 in your driving history? Even the quantity of time you've been driving can impact your insurance coverage premium.

More youthful chauffeurs typically pay more for insurance coverage since they have less experience on the roadway and are at higher danger of being included in a mishap. When identifying your premium, insurer consider a couple of factors associated with your cars and truck, such as http://jaidennqxh799.iamarrows.com/the-smart-trick-of-what-is-comprehensive-insurance-vs-collision-that-nobody-is-talking-about the cost to repair it and total security record.

Insurer use your credit-based insurance coverage score to anticipate the probability of you being in a mishap and submitting a claim. However note that California, Massachusetts and Hawaii have all prohibited using credit-based insurance coverage ratings in figuring out insurance coverage premiums. Do you have a long daily commute, or do you just drive to run errands on weekends? The more you drive, the higher your premium might be.

How Much Is Health Insurance A Month Things To Know Before You Buy

Collect and compare insurance quotes from several automobile insurance provider to assist you discover the finest protection and rates for your requirements (when does car insurance go down). And make certain to inquire about any possible insurance discount rates or other ways you might have the ability to bring down the cost of your cars and truck insurance premium. Need vehicle insurance? Erik Deckers is an expert blogger and ghostwriter, and is the co-author of Branding Yourself, No Bullshit Social Media, and The Owned Media Teaching.

Understanding fundamental health insurance coverage terms can help you select the strategy that may be the right choice for you. A health insurance coverage premium is a monthly charge you pay monthly for having medical insurance coverage. Prior to choosing a health insurance, thoroughly consider: Your current health Your average yearly healthcare costs Your available annual earnings for out-of-pocket medical costs Next, change your previous yearly healthcare costs for any changes to your present health.

Plans with low premiums typically don't start supplying coverage up until you have actually paid out-of-pocket for a substantial part of your medical expenditures. Other strategies might have higher monthly premiums, however cover a bigger portion of your medical expenses., you're responsible for paying the complete premium to your medical insurance company each month.

, your company may pay a portion of your premium. You'll be responsible for the remainder, which you can often organize to have actually deducted from your salary every month. You can not pay your health insurance premium with funds from your health cost savings account (HSA). These tax-free funds can only be utilized for out-of-pocket medical expenses.

Fascination About How Much Is Urgent Care Without Insurance

These investments are an essential part of the Australian economy, supporting companies, markets, facilities projects and the financial system. A lot of insurance providers are owned by shareholders (including superannuation funds and mutual fund) and the insurance provider has a responsibility to offer them with a return on their financial investment. The Australian Prudential Policy Authority (APRA) has guidelines needing insurance providers to have adequate capital to pay a really high volume of claims.

Shopping around to find the policy that finest matches your particular situations can cause you discovering a less expensive policy. Nevertheless, shopping on price alone may result in a policy that does not fulfill your particular requirements and leaves you financially exposed to certain threats. Minimizing your level of cover can decrease your premium, however it increases your threat of being underinsured.

Many insurance coverage allow you to define an excess. In basic, a greater excess will suggest you pay a lower premium Numerous insurers will offer you a more affordable premium if you take actions to decrease your threat. You might get a discount rate on your house and contents policy if you have security gadgets in place such as window locks and deadlocked doors.

Supplying additional info to the insurance provider about your particular threat may likewise permit your premium to be examined. You can likewise ask your insurance company about how you may be able to decrease your premium Each insurance provider will use items that differ from those provided by other insurance companies, with variations in thecoverage the terms and conditions, exemptions and costs Some insurance companies may offer discount rates such as a no claims or multi-policy discount if you have two or more policies with one company If you pay your premium by instalments it generally costs you more than if you select to pay your premium in one yearly lump sum payment.

Updated November 30, 2020 Editorial Note: Credit Karma gets payment from third-party advertisers, however that doesn't affect our editors' opinions. Our marketing partners don't evaluate, authorize or endorse our editorial content. It's accurate to the best of our knowledge when posted. Availability of products, functions and discount rates might vary by state or area.

We believe it is very important for you to comprehend how we make cash. It's quite simple, really. The offers for monetary products you see on our platform come from business who pay us. The cash we make helps us give you access to free credit history and reports and assists us develop our other excellent tools and educational products.

But given that we usually make money when you find an offer you like and get, we attempt to reveal you provides we think are a great match for you. That's why we offer features like http://jaidennqxh799.iamarrows.com/the-smart-trick-of-what-is-comprehensive-insurance-vs-collision-that-nobody-is-talking-about your Approval Chances and savings quotes. Naturally, the offers on our platform do not represent all monetary products out there, however our objective is to reveal you as numerous fantastic options as we can.

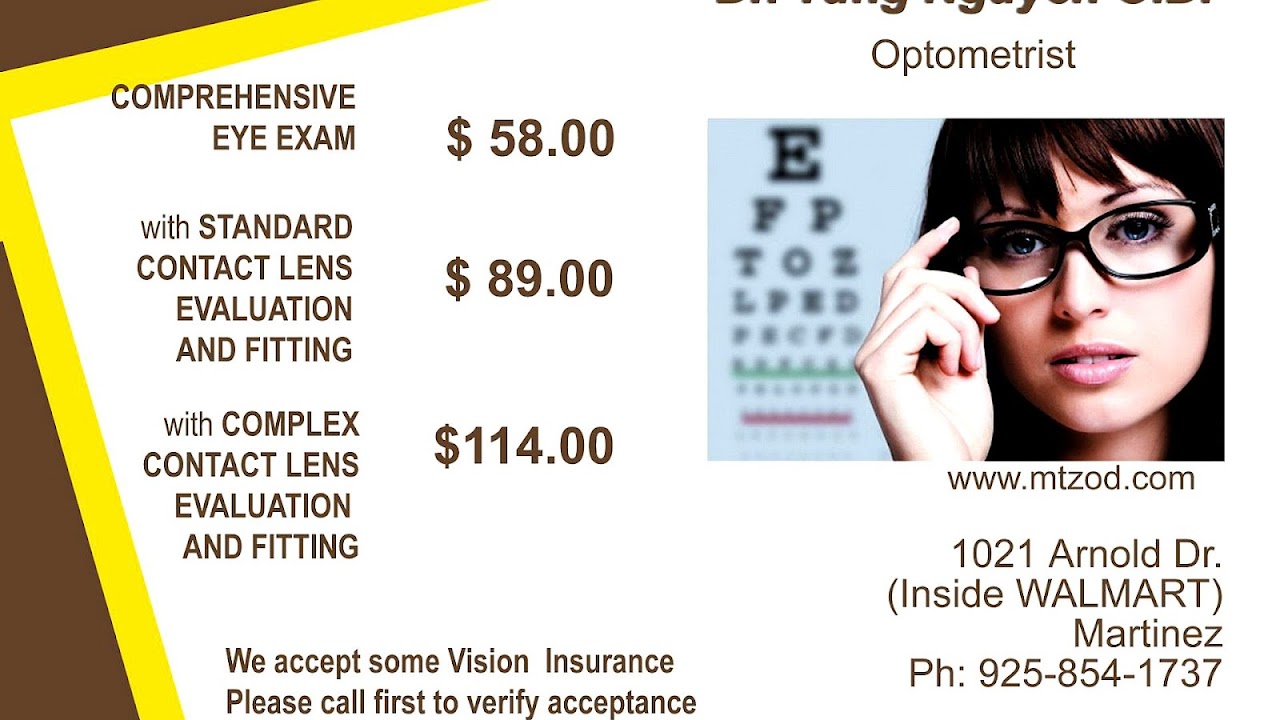

The 2-Minute Rule for How Much Is An Eye Exam Without Insurance

Let's have a look at how a car insurance coverage premium works, the average insurance coverage costs and the elements that can affect your insurance rates. Need automobile insurance? Your premium is the quantity of money you pay to an insurance business to provide insurance coverage on your lorry. Your car insurance premium may be paid monthly, every 6 months, or perhaps simply once a year, depending on the payment options your vehicle insurance provider uses.

Your vehicle insurance coverage premium costs are based partially on the types of insurance protection you select, however other aspects can impact your total cost (more on that later). In every state except New Hampshire, you're required to have a minimum amount of protection. This can help secure your wallet by covering costs up to the coverage limitation outlined in the policy you pick for example, to cover injuries or property damage you trigger another driver in a mishap.

The average liability insurance premium across the country was about $538 in 2015, according to the 2017 Auto Insurance Coverage Database Report from the National Association of Insurance Commissioners, or NAIC. Averages varied from one state to another, with a low of $298 in North Dakota and a high of almost $870 in New Jersey.

The expense of your vehicle insurance premium can depend on a variety of different elements some of which you can control (for example, where you live or the type of cars and truck you drive) and some that are out of your control (such as your age). Required car insurance coverage? Here are a few of the elements that could impact your cars and truck insurance rates.

And picking high protection limits and/or low deductibles will likely increase your cost of vehicle insurance, too. Are you a skilled chauffeur with no imperfections on your record? Or do you have a couple of tickets and a mishap or 2 in your driving history? Even the quantity of time you have actually been driving can impact your insurance premium.

More youthful chauffeurs frequently pay more for insurance coverage because they have less experience on the road and are at greater danger of being associated with a mishap. When determining your premium, insurer consider a couple of factors connected to your car, such as the expense to fix it and total security record.

Insurer use your credit-based insurance coverage rating to predict the probability of you being in a mishap and suing. But note that California, Massachusetts and Hawaii have actually all banned using credit-based insurance coverage scores in figuring out insurance coverage premiums. Do you have a long day-to-day commute, or do you just drive to run errands on weekends? The more you drive, the higher your premium might be.

The smart Trick of How Much Is Car Insurance A Month That Nobody is Talking About

Collect and compare insurance coverage quotes from numerous automobile insurance provider to assist you discover the best protection and rates for your needs (how to get cheaper car insurance). And make certain to ask about any possible insurance discount rates or other ways you may be able to lower the expense of your car insurance premium. Need automobile insurance? Erik Deckers is an expert blogger and ghostwriter, and is the co-author of Branding Yourself, No Bullshit Social Media, and The Owned Media Teaching.

Understanding standard medical insurance terms can help you choose the plan that might be the right option for you. A medical insurance premium is a regular monthly charge you pay every month for having medical insurance protection. Prior to selecting a health plan, thoroughly think about: Your existing health Your average annual healthcare expenses Your readily available yearly earnings for out-of-pocket medical expenditures Next, adjust your previous annual health care costs for any modifications to your current health.

Strategies with low premiums often don't begin providing protection till you've paid out-of-pocket for a substantial part of your medical expenses. Other strategies may have higher monthly premiums, but cover a larger portion of your medical expenses., you're responsible for paying the complete premium to your health insurance coverage company every month.

, your employer might pay a portion of your premium. You'll be accountable for the remainder, which you can frequently arrange to have subtracted from your wage every month. You can not pay your medical insurance premium with funds from your health cost savings account (HSA). These tax-free funds can just be used for out-of-pocket medical expenditures.

How Do Life Insurance Companies Make Money Fundamentals Explained

By understanding what a health insurance deductible is, you can find out how to minimize your healthcare expenditures. What is a deductible and how can it affect the cost of your healthcare? A deductible is the amount you pay out of pocket for medical services prior to your medical insurance plan starts to cover its share of the expenditures.

Deductibles are a staple in the majority of health insurance plans, and just how much you pay towards your deductible varies by strategy. According to Investopedia, "If you enter an accident and your medical costs are $2,000 and your deductible is $300, then you would have to pay the $300 out of pocket first prior to the insurer paid the remaining $1,700.

In addition to deductibles, there are other out-of-pocket expenditures you may be accountable for paying when you get medical insurance. Out-of-pocket costs consist of deductibles, coinsurance, and copays." is a method for you to share your health care expenses with your insurer. Your coinsurance can be anything from 50/50 to 80/20 depending upon the type of insurance plan you select.

This implies that a $500 treatment will only cost you $250 and the other $250 will be paid by your insurer (what is a premium in insurance). When it comes to an 80/20 coinsurance, that very same $500 treatment will just cost you $100, and your insurer will pay the other $400. A, or, is a flat charge that you pay for particular health care services when you have satisfied your deductible.

3 Easy Facts About How Much Is Long Term Care Insurance Explained

A copayment is an established cost for particular healthcare services that is required at the time you receive care. While most medical insurance plans consist of a deductible, how high or low your deductible is can vary. Generally, there are 2 types of strategies:, or; and, or.

For you, the benefit comes in lower monthly premiums. If you have a high-deductible plan, you are eligible for a (). These accounts enable you to reserve a limited quantity of pre-tax dollars for medical expenses. In the case http://gregoryocft990.tearosediner.net/some-ideas-on-how-to-apply-for-health-insurance-you-should-know of employer-sponsored health insurance coverage, business may contribute to their staff members' HSAs, often even matching employee contributions, resulting in significant pre-tax savings.

Since the money in your HSA isn't taxed like the rest of your income, it serves a double function: assisting you set aside cash to cover healthcare expenses and minimizing your tax concern." Since HDHPs' monthly premiums are generally low, it can be budget-friendly to people who are normally healthy and do not need to check out a medical professional except for annual exams or preventive care.

These preventive services consist of: Stomach aortic aneurysm screeningAlcohol misuse screening and counselingAspirin useBlood pressure screeningCholesterol screeningColorectal cancer screeningDepression screening Type 2 diabetes screeningDiet counselingHIV screeningImmunization vaccinesObesity screening and counselingSexually Transmitted Infection (STI) prevention counselingTobacco usage screening and cessation interventionsSyphilis screeningOn the other hand, a can be advantageous for people and households who require to frequently or consistently check out medical professionals, experts, and medical facilities for care.

Not known Details About How Much Does A Tooth Implant Cost With Insurance

However you'll pay a much higher premium for these plans. Though specifics differ by area and plan information, a low-deductible strategy can cost a minimum of twice as much monthly as a high-deductible strategy." In other words, if you're seeking to keep your month-to-month premiums low, you might opt for an HDHP.

No matter which type of plan you have an interest in, HealthMarkets can help you find the right one for your family. how much is long term care insurance. Contact us today to discuss your unique health requirements and compare your options. No matter how high or low your health policy's deductible is, having the choice to reduce just how much you pay of pocket can assist any household's budget.

The Premium Tax Credit is a subsidy that helps families making a modest income manage the expense of their regular monthly premiums. You can receive this subsidy in one of 2 methods: You can have this credit paid to your insurance business from the federal government to assist lower or cover the cost of your month-to-month premiums; orYou can declare the whole quantity of credit you're qualified for in your annual tax return.

You need to not be qualified for Medicaid, Medicare, CHIP, or TRICARE.You can not have access to affordable protection through your company's strategy. You should not be declared as a dependent by another person. The Cost-Sharing Reduction is an extra subsidy that helps households making a modest income pay for out-of-pocket expenditures when getting health care.

How Long Can A Child Stay On Parents Health Insurance Things To Know Before You Buy

In order to be qualified for this reduction, you should meet these requirements: You need to have a combined annual family earnings in between one hundred percent and 250 percent of the Federal Poverty Line. You need to be enrolled in a Silver-tiered health insurance. Desire to see if you're gotten approved for a health insurance coverage subsidy! .?. !? Talk to a licensed HealthMarkets agent today to see if your household meets the requirements for lowered regular monthly premiums or out-of-pocket expenses.

Make sure you can pay for to pay the premiums for the insurance plan you choose, as well as cover the deductible and any copayments or coinsurance that may be needed. Check to see what medical services use to the deductible. There are likely some medical services that the insurance plan will assist cover, even if you have actually not yet met your deductible.

Let a certified representative help you understand. When you're all set to read more about what a deductible is, and get the coverage your household requires, contact HealthMarkets. With our Best Rate Warranty, we're positive we can find cost effective health care choices with medical insurance suppliers regional to youand best of all, we'll do it free of charge.

Contact us online to get a totally free quote, meet one of our certified representatives personally, or call us at. Let's get you enrolled in a cost effective health plan today. Recommendations:" Meaning of 'Deductible' Investopedia." "Meaning of 'Coinsurance' Investopedia." "Definition of 'Copay' Investopedia." "Should I Choose A High Or Low Deductible Medical Insurance Strategy? Forbes." 2014.

The 2-Minute Rule for When Does Car Insurance Go Down

" Questions and Answers on the Premium Tax Credit Internal Revenue Service." 2015. "In Addition To Premium Credits, Health Law Uses Some Customers Assist Paying Deductibles And Co-Pays Kaiser Health News." 2013. "Discussing Healthcare Reform: Concerns About Health Insurance Coverage Subsidies KFF." 2014.

This weekly Q&A addresses questions from real patients about health care costs. Have a concern you wish to see answered? Submit it to AskChristina@nerdwallet. com. I am going shopping the federal Marketplace for a new health insurance coverage strategy. Though I understand the basics of health insurance coverage, deductibles have me confused. I am the sole income producer, residing in Houston with a wife and two children.

Given these circumstances, should I pick a high-deductible plan to conserve cash on regular monthly premiums or a low-deductible plan with greater premiums? Deductibles are a typical source of confusion, and with the huge array of choices in the Marketplace, your problem choosing the right strategy is reasonable. Comprehending how high- and low-deductible plans work, how month-to-month premiums play into your choice and how these strategies can affect your protection will assist ensure your family has the most proper healthcare plan in the coming year.

The Main Principles Of How Much Does Homeowners Insurance Cost

By understanding what a health insurance deductible is, you can learn how to conserve on your healthcare expenses. What is a deductible and how can it affect the cost of your healthcare? A deductible is the amount you pay of pocket for medical services before your health insurance plan begins to cover its share of the expenditures.

Deductibles are a staple in many health insurance coverage strategies, and how much you pay toward your deductible differs by strategy. According to Investopedia, "If you get into a mishap and your medical costs are $2,000 and your deductible is $300, then you would need to pay the $300 expense first prior to the insurer paid the staying $1,700.

In addition to deductibles, there are other out-of-pocket costs you might be accountable for paying when you receive health insurance coverage. Out-of-pocket costs consist of deductibles, coinsurance, and copays." is a method for you to share your health care costs with your insurer. Your coinsurance can be anything from 50/50 to 80/20 depending upon the kind of insurance coverage you choose.

This means that a $500 treatment will only cost you $250 and the other $250 will be paid by your insurer (how much does an eye exam cost without insurance). In the case of an 80/20 coinsurance, that exact same $500 procedure will only cost you $100, and your insurance provider will pay the other $400. A, or, is a flat cost that you pay for particular health care services as soon as you have fulfilled your deductible.

Rumored Buzz on How Much Is Health Insurance A Month For A Single Person?

A copayment is an established expense for particular health care services that is needed at the time you receive care. While many health insurance coverage strategies consist of a deductible, how high or low your deductible is can vary. Typically, there are two kinds of plans:, or; and, or.

For you, the benefit is available in lower monthly premiums. If you have a high-deductible plan, you are eligible for a (). These accounts allow you to reserve a restricted quantity of pre-tax dollars for medical expenses. When it comes to employer-sponsored medical insurance, companies may contribute to their staff members' HSAs, in some cases even matching employee contributions, resulting in substantial pre-tax cost savings.

Since the money in your HSA isn't taxed like the rest of your income, it serves a double function: helping you set aside money to cover health care costs and reducing your tax concern." Due to the fact that HDHPs' month-to-month premiums are generally low, it can be cost effective to individuals who are usually healthy and do not need to check out a physician except for annual tests or preventive care.

These preventive services consist of: Stomach aortic aneurysm screeningAlcohol abuse screening and counselingAspirin useBlood pressure screeningCholesterol screeningColorectal cancer screeningDepression screening Type 2 diabetes screeningDiet counselingHIV screeningImmunization vaccinesObesity screening and counselingSexually Sent Infection (STI) prevention counselingTobacco use screening and cessation interventionsSyphilis screeningOn the other hand, a can be advantageous for individuals and households who need to regularly or routinely go to medical professionals, specialists, and medical facilities for care.

The Basic Principles Of How Much Is Car Insurance A Month

But you'll pay a much greater premium for these plans. Though specifics vary by place and strategy information, a low-deductible strategy can cost at least two times as much monthly as a high-deductible plan." Simply put, if you're seeking to keep your monthly premiums low, you might opt for an HDHP.

No matter which type of plan you have an interest in, HealthMarkets can assist you discover the best one for your family. how to cancel state farm insurance. Contact us today to discuss your unique health requirements and compare your alternatives. No matter how high or low your health policy's deductible is, having the option to lower just how much you pay of pocket can assist out any household's budget.

The Premium Tax Credit is an aid that assists families making a modest earnings manage the expense of their month-to-month premiums. You can get this aid in one of 2 ways: You can have this credit paid to your insurer from the federal government to assist lower or cover the cost of your regular monthly premiums; orYou can declare the whole quantity of credit you're qualified for in your annual tax return.

You need to not be eligible for Medicaid, Medicare, CHIP, or TRICARE.You can not have access to budget friendly protection through your company's strategy. You should not be claimed as a reliant by another person. The Cost-Sharing Decrease is an additional subsidy that helps households making a modest earnings afford out-of-pocket costs when getting healthcare.

The smart Trick of How To Get Dental Implants Covered By Insurance That Nobody is Discussing

In order to be eligible for this decrease, you must satisfy these requirements: You must have a combined annual home income in between 100 percent and 250 percent of the Federal Poverty Line. You should be enrolled in a Silver-tiered health insurance. Desire to see if you're qualified for a health insurance coverage aid! .?. !? Consult with a certified HealthMarkets representative today to see if your household fulfills the requirements for lowered regular monthly premiums or out-of-pocket costs.

Be sure you can pay for to pay the premiums for the insurance strategy you select, as well as cover the deductible and any copayments or coinsurance that might be needed. Examine to see what medical services apply to the deductible. There are likely some medical services that the insurance coverage plan will help cover, even if you have actually not yet fulfilled your deductible.

Let a licensed agent assistance you comprehend. When you're all set to get more information about what a deductible is, and get the coverage your household requires, contact HealthMarkets. With our Finest Cost Guarantee, we're confident we can find inexpensive healthcare alternatives with health insurance coverage suppliers local to youand most importantly, we'll do it for totally free.

Contact us online to get a free quote, consult with among our licensed agents in person, or call us at. Let's get you registered in a cost effective health plan today. Recommendations:" Definition of 'Deductible' Investopedia." "Meaning of 'Coinsurance' Investopedia." "Definition of 'Copay' Investopedia." "Should I Select A High Or Low Deductible Medical Insurance Strategy? Forbes." 2014.

How What Is A Certificate Of Insurance can Save You Time, Stress, and Money.

" Questions and Responses on the Premium Tax Credit IRS." 2015. "In Addition To Premium Credits, Health Law Provides Some Consumers Help Paying Deductibles And Co-Pays Kaiser Health News." 2013. "Describing Health Care Reform: Questions About Health Insurance Subsidies KFF." 2014.

This weekly Q&A addresses http://gregoryocft990.tearosediner.net/some-ideas-on-how-to-apply-for-health-insurance-you-should-know questions from genuine clients about health care expenses. Have a concern you 'd like to see answered? Send it to AskChristina@nerdwallet. com. I am shopping the federal Market for a brand-new health insurance plan. Though I comprehend the fundamentals of medical insurance, deductibles have me puzzled. I am the sole breadwinner, living in Houston with an other half and 2 young kids.

Offered these circumstances, should I select a high-deductible plan to conserve money on monthly premiums or a low-deductible strategy with higher premiums? Deductibles are a common source of confusion, and with the huge array of options in the Market, your difficulty choosing the right strategy is easy to understand. Comprehending how high- and low-deductible plans work, how monthly premiums play into your choice and how these plans can impact your protection will help guarantee your family has the most suitable healthcare strategy in the coming year.

The Best Guide To Why Is My Car Insurance So High

By understanding what a medical insurance deductible is, you can find out how to conserve on your healthcare expenditures. What is a deductible and how can it affect the expense of your healthcare? A deductible is the amount you pay of pocket for medical services before your health insurance coverage strategy begins to cover its share of the costs.

Deductibles are a staple in the majority of health insurance coverage plans, and how much you pay towards your deductible differs by plan. According to Investopedia, "If you enter an accident and your medical expenditures are $2,000 and your deductible is $300, then you would need to pay the $300 expense first prior to the insurance provider paid the remaining $1,700.

In addition to deductibles, there are other out-of-pocket costs you might be accountable for paying when you receive health insurance coverage. Out-of-pocket costs consist of deductibles, coinsurance, and copays." is a method for you to share your health care costs with your insurance company. Your coinsurance can be anything from 50/50 to 80/20 depending on the kind of insurance coverage you select.

This means that a $500 procedure will only cost you $250 and the other $250 will be paid by your insurance provider (what health insurance pays for gym membership?). In the case of an 80/20 coinsurance, that same $500 procedure will just cost you $100, and your insurance provider will pay the other $400. A, or, is a flat cost that you pay for particular healthcare services once you have fulfilled your deductible.

How To Become An Insurance Broker for Beginners

A copayment is an established cost for specific health care services that is needed at the time you get care. While the majority of health insurance coverage plans include a deductible, how high or low your deductible is can vary. Usually, there are 2 types of strategies:, or; and, or.

For you, the advantage comes in lower month-to-month premiums. If you have a high-deductible strategy, you are qualified for a (). These accounts permit you to reserve a restricted amount of pre-tax dollars for medical expenditures. In the case of employer-sponsored medical insurance, business might add to their employees' HSAs, sometimes even matching staff member contributions, resulting in substantial pre-tax savings.

Due to the fact that the cash in your HSA isn't taxed like the rest of your income, it serves a dual function: helping you reserved money to cover health care costs and lowering your tax burden." Since HDHPs' monthly premiums are usually low, it can be inexpensive to people who are usually healthy and don't need to go to a physician except for annual examinations or preventive care.

These preventive services include: Stomach aortic aneurysm screeningAlcohol misuse screening and counselingAspirin useBlood pressure screeningCholesterol screeningColorectal cancer screeningDepression screening Type 2 diabetes screeningDiet counselingHIV screeningImmunization vaccinesObesity screening and counselingSexually Sent Infection (STI) avoidance counselingTobacco usage screening and cessation interventionsSyphilis screeningOn the other hand, a can be helpful for individuals and families who need to frequently or consistently go to medical professionals, specialists, and medical facilities for care.

Facts About How Much Do Prescription Drugs Cost Without Insurance? Uncovered

However you'll pay a much greater premium for these plans. Though specifics differ by area and plan details, a low-deductible strategy can cost at least two times as much each month as a high-deductible plan." In short, if you're aiming to keep your month-to-month premiums low, you may select an HDHP.

No matter which type of plan you're interested in, HealthMarkets can assist you find the right one for your household. how much do dentures cost without insurance. Contact us today to discuss your distinct health requirements and compare your options. No matter how high or low your health policy's deductible is, having the option to reduce how much you pay out of pocket can assist any household's budget plan.

The Premium Tax Credit is an aid that assists families making a modest earnings afford the cost of their monthly premiums. You can get this aid in one of two methods: You can have this credit paid to your insurance provider from the federal government to assist lower or cover the cost of your month-to-month premiums; orYou can declare the entire amount of credit you're eligible for in your yearly income tax return.

You should not be eligible for Medicaid, Medicare, CHIP, or TRICARE.You can not have access to inexpensive coverage through your company's plan. You should not be claimed as a reliant by another individual. The Cost-Sharing Reduction is an extra aid that helps households making a modest earnings pay for out-of-pocket expenditures when getting health care.

Little Known Questions About How Many Americans Have Health Insurance.

In order to be eligible for this decrease, you need to fulfill these requirements: You need to have a combined annual household earnings in between one hundred percent and 250 percent of the Federal Hardship Line. You should be registered in a Silver-tiered health strategy. Wish to see if you're received a health insurance coverage subsidy! .?. !? Speak with a certified HealthMarkets representative today to see if your family satisfies the requirements for decreased monthly premiums or out-of-pocket expenses.

Be sure you can pay for to pay the premiums for the insurance coverage plan you choose, along with cover the deductible and any copayments or coinsurance that might be needed. Check to see what medical services apply to the deductible. There are likely some medical services that the insurance coverage strategy http://gregoryocft990.tearosediner.net/some-ideas-on-how-to-apply-for-health-insurance-you-should-know will help cover, even if you have actually not yet satisfied your deductible.

Let a licensed representative aid you comprehend. When you're prepared to get more information about what a deductible is, and get the coverage your family needs, contact HealthMarkets. With our Finest Rate Warranty, we're positive we can find cost effective healthcare alternatives with medical insurance service providers regional to youand most importantly, we'll do it totally free.

Contact us online to get a complimentary quote, consult with one of our licensed agents in individual, or call us at. Let's get you registered in a budget friendly health strategy today. Recommendations:" Definition of 'Deductible' Investopedia." "Meaning of 'Coinsurance' Investopedia." "Definition of 'Copay' Investopedia." "Should I Choose A High Or Low Deductible Health Insurance Coverage Plan? Forbes." 2014.

Examine This Report on What Is The Cheapest Car Insurance

" Questions and Answers on the Premium Tax Credit Internal Revenue Service." 2015. "In Addition To Premium Credits, Health Law Provides Some Customers Assist Paying Deductibles And Co-Pays Kaiser Health News." 2013. "Discussing Health Care Reform: Concerns About Medical Insurance Subsidies KFF." 2014.

This weekly Q&A addresses questions from genuine clients about health care expenses. Have a question you wish to see responded to? Send it to AskChristina@nerdwallet. com. I am shopping the federal Market for a new health insurance coverage plan. Though I understand the fundamentals of medical insurance, deductibles have me confused. I am the sole income producer, residing in Houston with a better half and 2 children.

Given these situations, should I choose a high-deductible plan to conserve cash on month-to-month premiums or a low-deductible strategy with greater premiums? Deductibles are a typical source of confusion, and with the vast range of choices in the Market, your problem choosing the right plan is reasonable. Comprehending how high- and low-deductible strategies work, how monthly premiums play into your decision and how these plans can affect your coverage will assist ensure your family has the most proper health care strategy in the coming year.

3 Easy Facts About What Is The Best Dental Insurance Shown

A policy's money value can offer many benefits that you can utilize while you're still alive. It can require time for it to grow into a beneficial quantity, but when that happens, you can obtain cash versus your policy's money value, utilize it to pay premiums, and even surrender it for money in retirement.

While there's no warranty that dividends will be declared each year, Guardian has paid them every year given that 1868, even during wars, pandemics, or stock exchange turbulence. Depending upon your requirements, you can choose to use your dividends in different methods. One option is to buy paid-up additions (PUAs). 7 A PUA is ensured irreversible, paid-up life insurance coverage.

Dividend accumulations can also be withdrawn tax-free, up to the policy basis (i. e., the amount of premiums paid to date). In addition to buying PUAs, Guardian uses policyholders these dividend alternatives: Get in cash Minimize premium Purchase extra term insurance coverage Accumulate with interest Apply to impressive policy loans Here's how the death advantage of an entire life policy can grow with paid-up extra insurance acquired by dividends.

Entire life insurance coverage is a permanent policy, which gives you guaranteed defense for your liked ones that lasts a life time. With whole life insurance, unlike term, you earn ensured money worth, which you can utilize however you want. Getting involved whole life insurance coverage is qualified to make dividends,1 which can increase the survivor benefit and the money worth of the policy.

Getting The Which One Of These Is Covered By A Specific Type Of Insurance Policy? To Work

Retirement and your monetary future. Hmm. you'll get around to thinking of it one day. And life insurance? That too. But here's the funny feature of lifewe can't control it. Things occur that we never see coming, and there's really little we can really prepare for. That's why it's so crucial to get things in place right now that we can controllike life insurance coverage.

When you boil things down, you really have two alternatives when it comes to life insuranceterm vs. entire life. One is a safe plan that helps secure your household and the other one, well, it's a total rip-off. Term life insurance supplies life insurance protection for a specific quantity of time.

Term life insurance coverage plans are far more affordable than whole life insurance. This is since the term life policy has no money value up until you or your partner passes away. In the simplest of terms, it's not worth anything unless one of you were to die throughout the course of the term.

Naturally, the hope here is you'll never have to use your term life insurance coverage policy at allbut if something does take place, at least you understand your family will be looked after. The premiums on whole life insurance coverage (sometimes called money worth insurance) are usually more expensive than term life for a number of reasons.

Examine This Report on How To Become An Insurance Adjuster

It might sound like an advantage to have life insurance protection for your whole life. However here's the reality: If you practice the concepts we teach, you will not require life insurance coverage forever. Eventually, you'll be self-insured. Why? Due to the fact that you'll have zero financial obligation, a complete emergency fund and a large quantity of money in your financial investments.

It resembles Dave states in his book The Complete Guide to Money, "Life insurance coverage has one job: It replaces your income when you die." There are even more productive and lucrative ways to invest your money than utilizing your life insurance plan. What seem https://www.forbes.com/sites/christopherelliott/2020/06/27/how-do-i-get-rid-of-my-timeshare-in-a-pandemic/#53347f866a07 like more enjoyable to youinvesting in growth stock shared funds so you can enjoy your retirement or "investing" cash in a plan that's all based upon whether you kick the bucket? We think the answer is quite easy.

He shops around and discovers he can acquire approximately $125,000 in insurance coverage for his household. From the entire life insurance agent, he'll most likely hear a pitch for a $100 per month policy that will develop cost savings for retirement, which is what a money value policy is supposed to do.

So, if Greg chooses the entire life, money worth alternative, he'll pay a substantial monthly premium. And the part of his premium that isn't going towards actually guaranteeing him, goes towards his money worth "investment," right? https://vimeo.com/user64148215 Well you 'd think, however then come the charges and expenses. That extra $82 each month vanishes into commissions and costs for the first three years.

Facts About How Much Do Prescription Drugs Cost Without Insurance? Revealed

Even worse yet, the savings he does manage to develop up after being swindled for 20 years won't even go to his household when he passes away - how does whole life insurance work. Greg would require to withdraw and spend that cash worth while he was still alive. Talk about pressure! The only advantage his household will receive is the stated value of the policy, which was $125,000 in our example.

That's a great deal of value! You need to acquire a term life insurance policy for 1012 times your annual earnings. That way, your salary will be changed for your family if something takes place to you - who has the cheapest car insurance. You can run the numbers with our term life calculator. And do not forget to get term life insurance for both spouses, even if among you remains at house with the kids.

Wish to make certain your family is covered no matter what happens? Examine on your protection before it ends up being an emergency situation. Take our 5-minute coverage checkup to ensure you have what you require. Dave suggests you buy a policy with a term that will see you through till your kids are avoiding to college and living on their own.

A great deal of life can take place in twenty years. Let's say you get term life insurance coverage when you're 30 years old - why is car insurance so expensive. You and your spouse have a cute little two-year-old toddler running around. You're laser-focused on settling all your debt (including your house) and eagerly anticipate investing and retirement planning in the future.

How Much Do Dentures Cost Without Insurance Things To Know Before You Buy

The years passed quickly, didn't they? But look where you are! You're debt-free (your home and everything), and with your 401( k), cost savings and mutual funds, you're sitting at a cool net worth of $500,0001. 5 million! The years were good to you, and it's all because you had a strategy.

At this point, (even without life insurance) if something were to occur to you or your spouse, the making it through spouse would have the ability to live off your cost savings and financial investments. Congratulations, you have actually ended up being self-insured! When you end up being more economically safe and secure, you have less and less of a need for life insurance.

Life is valuable! And the ideal time to buy life insurance coverage is when you're young and have a tidy costs of health. Specifically since life insurance coverage companies are all about weighing the dangers of the individual acquiring the policy. Zander Insurance is the only business that Dave Ramsey recommends for term life insurance coverage.

Compare Policies With 8 Leading Insurance companies Whole life insurance is one kind of permanent life insurance coverage that can offer long-lasting protection. It provides a variety of guarantees, which can be appealing to someone who doesn't want any uncertainty after buying life insurance coverage. Entire life insurance coverage combines an investment account called "money worth" and an insurance coverage item.

All about How Much Is Health Insurance A Month For A Single Person?

A policy's money value can provide many advantages that you can use while you're still alive. It can take some time for it to become an useful quantity, but when that takes place, you can borrow cash against your policy's cash value, use it to pay premiums, and even surrender it for money in retirement.

While there's no warranty that dividends will be stated each year, Guardian has paid them every year given that 1868, even during wars, pandemics, or stock exchange turbulence. Depending on your requirements, you can choose to use your dividends in different ways. One option is to acquire paid-up additions (PUAs). 7 A PUA is ensured irreversible, paid-up life insurance coverage.

Dividend accumulations can also be withdrawn tax-free, approximately the policy basis (i. e., the amount of premiums paid to date). In addition to acquiring PUAs, Guardian provides policyholders these dividend options: Get in money Decrease premium Purchase additional term insurance Accumulate with interest Apply to impressive policy loans Here's how the death advantage of an entire life policy can grow with paid-up additional insurance acquired by dividends.

Whole life insurance coverage is a permanent policy, which offers you ensured defense for your liked ones that lasts a life time. With whole life insurance coverage, unlike term, you make ensured cash worth, which you can use however you desire. Getting involved entire life insurance is qualified to make dividends,1 which can increase the death benefit and the cash worth of the policy.

Unknown Facts About How Much Is Domino's Pizza Insurance

Retirement and your financial future. Hmm. you'll get around to considering it one day. And life insurance coverage? That too. But here's the funny aspect of lifewe can't manage it. Things occur that we never see coming, and there's extremely little we can in fact prepare for. That's why it's so essential to get things in location today that we can controllike life insurance.

When you boil things down, you actually have two choices when it comes to life insuranceterm vs. entire life. One is a safe plan that assists safeguard your https://vimeo.com/user64148215 family and the other one, well, it's an overall rip-off. Term life insurance supplies life insurance protection for a particular amount of time.

Term life insurance plans are far more budget-friendly than whole life insurance coverage. This is since the term life policy has no money worth until you or your partner dies. In the easiest of terms, it's not worth anything unless one of you were to pass away during the course of the term.

Obviously, the hope here is you'll never ever have to use your term life insurance policy at allbut if something does take place, a minimum of you understand your family will be taken care of. The premiums on whole life insurance (sometimes called money value insurance) are generally more costly than term life for a number of factors.

Some Known Facts About How Much Is Private Mortgage Insurance.

It may sound like a good thing to have life insurance coverage for your whole life. However here's the truth: If you practice the principles we teach, you won't require life insurance permanently. Eventually, you'll be self-insured. Why? Due to the fact that you'll have absolutely no debt, a complete emergency fund https://www.forbes.com/sites/christopherelliott/2020/06/27/how-do-i-get-rid-of-my-timeshare-in-a-pandemic/#53347f866a07 and a significant amount of money in your investments.

It's like Dave states in his book The Total Guide to Money, "Life insurance coverage has one task: It replaces your earnings when you pass away." There are even more productive and lucrative methods to invest your money than utilizing your life insurance plan. What noises like more enjoyable to youinvesting in development stock mutual funds so you can enjoy your retirement or "investing" money in a strategy that's all based upon whether you bite the dust? We believe the answer is pretty simple.

He search and discovers he can buy an average of $125,000 in insurance for his family. From the entire life insurance representative, he'll probably hear a pitch for a $100 monthly policy that will develop cost savings for retirement, which is what a money worth policy is expected to do.

So, if Greg chooses the entire life, money value choice, he'll pay a significant regular monthly premium. And the part of his premium that isn't going towards actually insuring him, goes towards his money worth "financial investment," right? Well you 'd believe, however then come the charges and expenditures. That additional $82 per month vanishes into commissions and expenses for the first 3 years.

What Does How To Get Dental Implants Covered By Insurance Do?

Even worse yet, the savings he does handle to develop after being ripped off for 20 years won't even go to his family when he dies - what is deductible in health insurance. Greg would have needed to withdraw and invest that money worth while he was still alive. Discuss pressure! The only advantage his family will receive is the stated value of the policy, which was $125,000 in our example.

That's a lot of value! You should acquire a term life insurance coverage policy for 1012 times your yearly earnings. That way, your salary will be changed for your household if something takes place to you - how to fight insurance company totaled car. You can run the numbers with our term life calculator. And do not forget to get term life insurance coverage for both partners, even if among you remains at house with the kids.

Wish to make sure your family is covered no matter what occurs? Inspect on your protection prior to it becomes an emergency situation. Take our 5-minute protection checkup to make sure you have what you require. Dave suggests you purchase a policy with a term that will see you through until your kids are avoiding to college and living on their own.

A lot of life can happen in twenty years. Let's state you get term life insurance when you're 30 years old - how much renters insurance do i need. You and your spouse have a charming little two-year-old young child running around. You're laser-focused on settling all your debt (including the house) and look forward to investing and retirement preparation in the future.

The Buzz on How Much Does Gap Insurance Cost

The years passed quickly, didn't they? But look where you are! You're debt-free (your house and whatever), and with your 401( k), savings and mutual funds, you're sitting at a cool net worth of $500,0001. 5 million! The years were good to you, and it's all because you had a plan.

At this point, (even without life insurance coverage) if something were to happen to you or your spouse, the enduring partner would be able to live off your cost savings and investments. Congratulations, you've ended up being self-insured! When you end up being more financially safe and secure, you have less and less of a requirement for life insurance coverage.

Life is valuable! And the perfect time to purchase life insurance coverage is when you're young and have a tidy expense of health. Particularly considering that life insurance coverage business are all about weighing the risks of the individual purchasing the policy. Zander Insurance coverage is the only business that Dave Ramsey recommends for term life insurance.

Compare Policies With 8 Leading Insurers Whole life insurance is one type of irreversible life insurance coverage that can provide lifelong protection. It provides a range of guarantees, which can be interesting someone who doesn't desire any guesswork after buying life insurance. Entire life insurance coverage integrates an investment account called "money worth" and an insurance item.

The smart Trick of What Does Enterprise Car Rental Insurance Cover That Nobody is Discussing

These policies would generally cost more in advance, because the insurance provider requires to develop up enough money worth within the policy throughout the payment years to money the policy for the remainder of the insured's life - how to cancel state farm insurance. With Getting involved policies, dividends might be applied to shorten the premium paying duration.

These policies usually have costs throughout early policy years must the policyholder money it in. This type is fairly new, and is likewise referred to as either "excess interest" or "present assumption" whole life. The policies are a mix of standard whole life and universal life. Rather of using dividends to enhance guaranteed money value build-up, the interest on the policy's cash worth differs with current market conditions.

Like universal life, the superior payment might vary, Go here however not above the optimal premium ensured within the policy. Whole life insurance coverage generally requires that the owner pay premiums for the life of the policy. There are some plans that let the policy be "paid up", which indicates that no further payments are ever required, in as couple of as 5 years, or with even a single large premium.

However, some whole life agreements provide a rider to the policy which permits a one time, or periodic, big additional premium payment to be made as long as a very little extra payment is made on a routine schedule. On the other hand, universal life insurance coverage generally permits more versatility in premium payment.

Some Ideas on What Is The Difference Between Term And Whole Life Insurance You Should Know

The dividends can be taken in one of three methods. The policy owner can be provided a cheque from the insurer for the dividends, the dividends can be used to lower the premium payment, or the dividends can be reinvested back into the policy to increase the death advantage and the cash value at a quicker rate.

The money worth will grow tax-deferred with compounding interest. Although the growth is considered "tax-deferred," any loans drawn from the policy will be tax-free as long as the policy stays in force. In addition, the death benefit stays tax-free (suggesting no earnings tax and no estate tax) - how to become an insurance adjuster. As the cash worth boosts, the Extra resources death benefit will likewise increase and this development is likewise non-taxable.

The majority of whole life policies can be surrendered at any time for the cash worth quantity, and income taxes will normally just be put on the gains of the cash account that goes beyond the total premium investment. Hence, many are using whole life insurance policies as a retirement funding car instead of for danger management.

The majority of companies will move the cash into the policy holder's savings account within a few days. Money worths are also liquid adequate to be used for investment capital, however just if the owner is financially healthy sufficient to continue making superior payments (Single premium whole life policies avoid the risk of the insured stopping working to make premium payments and are liquid adequate to be used as security.

How Long Can Children Stay On Parents Insurance Things To Know Before You Get This

Due to the fact that these policies are totally paid at beginning, they have no monetary danger and are liquid and safe and secure sufficient to be used as collateral under the insurance coverage provision of security assignment.) Cash worth access is tax free approximately the point of overall premiums paid, and the rest might be accessed tax totally free in the type of policy loans.

If the insured passes away, survivor benefit is minimized by the quantity of any impressive loan balance. Internal rates of return for participating policies might be much worse than universal life and interest-sensitive entire life (whose cash worths are purchased the money market and bonds) due to the fact that their cash values are invested in the life insurance coverage business and its general account, which might remain in real estate and the stock exchange.

Variable universal life insurance coverage might exceed whole life since the owner can direct investments in sub-accounts that may do much better. If an owner desires a conservative position for his cash values, par entire life is suggested. Documented cash worths may appear to "vanish" or end up being "lost" when the death advantage is paid.

The insurance provider pays the money values with the survivor benefit because they are inclusive of each other. This is why loans from the cash value are not taxable as long as the policy is in force (due to the fact that survivor benefit are not taxable). Life Insurance Coverage, a Consumer's Handbook/ Belth second ed p23 Life Insurance, a Consumer's Handbook/ Belth 2nd ed p22 Tax Facts/ The National Underwriter 2015 Ed p39 Tax Truths/ National Underwriter 2015 Ed P32 IRC Sec 2042 " Businesses - Life Takes Place".

More About What Is A Deductible For Health Insurance

Life Insurance/ Huebner & Black Ch 3 Life Insurance/Huebner & Black 9th ed P6 Life Insurance/ Huebner & Black 9th Ed P 277-279 Alexander B. Grannis, Chair. how much does life insurance cost. " The Feeling's Not Shared". New York City State Assembly. Recovered 2007-01-15. "Life Insurance" Huebner & Black/ 9th ed p320 BEST'S FLITCRAFT 1985 Ed P561 " A Guide to Life Insurance Coverage".

Archived from the initial on 2006-12-10. Retrieved 2007-01-16. " glossary". Life and Health Insurance Foundation for Education. Recovered 2007-01-15. Florida Life and Health Research Study Handbook, 12 edition " Whole Life Insurance Coverage". The Possession Security Book. Archived from the initial on 2007-01-14. Obtained 2007-01-17.

Whole life insurance coverage is a long-term insurance coverage guaranteed to stay in force for the life of the insured as long as premiums are paid. When you initially apply for coverage, you are http://legona0a22.booklikes.com/post/3722082/what-does-i-need-surgery-and-have-no-insurance-where-can-i-get-help-mean agreeing to an agreement in which the insurance provider assures to pay your beneficiary a certain quantity of money called a death advantage when you pass.

As long as you pay your premiums, your whole life insurance coverage policy will remain in result and your premiums will stay the exact same regardless of health or age changes. For example, let's say you buy a whole life insurance policy at age 40. When you buy the policy, the premiums will be secured for the life of the policy as long as you pay them.

What Is Deductible In Health Insurance - The Facts